GameStop: The Long-Term Compounder Hidden in Plain Sight

Why I believe the notorious meme stock is a deeply misunderstood “Easter egg” of a long-term investment

Ahh, GameStop… The totally non-polarizing subject where Wall Street purists, Reddit conspiracists, squeeze chasers, and even a kitty come together to politely debate. Truly the modern town square of reasonable discourse in this civil society we find ourselves in!

Kidding aside, let’s first acknowledge the elephant in the room:

While there is clearly value ascribed to meme, especially in today’s markets, let me be clear: I’m not here to peddle tinfoil conspiracies or MOASS theories. While my attention to GameStop began for the same reason as everyone else’s, I’ve become convinced there’s genuine long-term value here – a compounder ignored due to meme stigma. I don’t just “like the stock,” I love it.

This write up is my overall GameStop investment thesis, which will be soon followed by a more quantitative valuation analysis. After reading my thesis, I invite you to please share any critical feedback as to where I may be misinformed or misguided – I want to hear it.

And one point of information before I get into the weeds: I want to make clear that GameStop is but one of many investment ideas and themes that I am very enthusiastic about as this era of populism, currency debasement, and geopolitical/global trade rewriting evolves. By no means would I encourage anyone to put more than a reasonable allocation into any single idea, particularly one as risky and volatile as this one. However, as a risk-loving and thoroughly convinced reformed degen, unless the facts on the ground change – or I am convinced otherwise – while I already own a small position in my personal account, I intend to initiate a max position size in this idea in my soon-to-launch Easter Egg Fund.

As a complement to this analysis, this recent interview with Ryan Cohen provides a telling glimpse into his approach to fundamentally growing the business with an owner mentality, some assuring confidence around PowerPacks and collectibles, and just generally shows he is a quality leader approaching business with integrity. (I personally do not agree with his AI doomer perspective displayed here but that is neither here nor there for this analysis.)

In this analysis I’ll cover the following key areas of conviction for GameStop as a long-term holding:

Ryan Cohen & Board Incentive Alignment

Balance Sheet Strength & Profitability

Organic Growth Initiatives

“Monetize the Apes” M&A Possibilities

The Tesla Effect (Reflexivity) – The Past Is Not The Present

Reddit Theories and Pumps as a Bonus “Call Option”

Volatility Breeds Income Opportunities

Here goes…

Ryan Cohen & Board Incentive Alignment

This part is easy. There is plainly 100% alignment between Ryan Cohen (GameStop’s CEO), the board, and long-term GameStop shareholders.

Cohen has not received a penny in salary, or any equity compensation. He has purchased all of his stake, totaling over 37 million shares. He’s an owner, not just an operator collecting a paycheck. 100% alignment.

As for the board, as of 2024, GameStop eliminated all cash and equity compensation for non-employee directors. Their only financial exposure now comes from personally owned shares. 100% alignment.

This is why I find claims of ill intentions towards retail by Cohen and the board… I’ll be gracious, misinformed. They would be hurting themselves if they were hurting retail by “dumping” shares on them with an offering or selling convertible notes. It also means that they genuinely believe it’s better for shareholders to wait for better M&A opportunities, and that the current level of Bitcoin holdings are appropriate. I happen to agree on all fronts.

It’s not complicated. Cohen and the board are aligned with shareholders – we just have to be patient and play the long game.

Balance Sheet Strength & Profitability

Yes, over the years revenue has come down markedly as retail and gaming has pivoted to digital and GameStop experienced its “Sears” problems. Indeed, there won’t suddenly be a resurgence of people rushing to the local mall to exchange their physical games, but this misses the point of the company’s newfound financial health, let alone what is to come.

From a balance sheet perspective alone, the company appears conservatively valued. Cash and equivalents sit at almost $9B, its 4,710 Bitcoin are worth ~$500M, and the only debt the company carries is its 0.00% convertible senior notes outstanding of ~$4.2B (2030s and 2032s). Even excluding intangible assets such as brand, IP, or goodwill – which clearly have value – this gets you to over $5B of book value, and growing. A fortress balance sheet.

I say “and growing” because the business is now profitable and is becoming more so. The financial statements are there for anyone to look at so I will not get too granular here, but the company has aggressively attacked bloat by closing underperforming physical store locations, taken dramatic SG&A cost cutting measures, and foreign market assets have been or are in the process of being divested, all of which is streamlining operations to focus on profitable operations and growth efforts. On the Revenue side, without getting into the new growth markets (next section), while software sales (games) continued their decline down 27% year over year as would be expected due to fewer stores, hardware and accessory sales actually rose 31% year over year to over $592 million, benefiting from Nintendo Switch 2 hardware sales, which position the business well headed into the holidays.

The company is now simply profitable at the operating level, with net income further amplified by interest income that some critics dismiss as “not real revenue”.

Despite the significant store closures, revenues are ticking up lately, which brings me to….

Organic Growth Initiatives

Whether people choose to recognize it or not, GameStop has been making the right moves from an organic growth perspective towards high-margin segments with greater scalability, which are already bearing fruit. This is not financially engineered growth through M&A – just cold, hard sales and pre-revenue growth initiatives.

The collectibles segment is the primary area of organic expansion. Collectibles revenue grew ~63% year-over-year to $227.6 million in Q2 FY 2025, representing roughly 23% of total sales. This includes card sales as well as a partnership with PSA to turn GameStop’s storefront into grading submission centers.

Importantly, the Q2 results don’t even capture a promising new extension of GameStop’s partnership with PSA to launch Power Packs! Power Packs entered public beta in July 2025, allowing collectors to digitally open PSA-graded cards, after which customers can choose to store them in PSA’s Vault, physically ship them home, or instantly sell them back to GameStop. This sale process captures the dopamine of pack-opening – a naturally sticky and gambling-like dynamic especially in a digital environment. One beautiful element here is that if the card(s) are sold back to GameStop (at a 10% discount to PSA value), payment is made in Power Packs credit, which can be withdrawn for cash but provides a nice flywheel back into additional sales and is effectively interest-free operating capital.

With regard to Power Packs and collectibles in general, it’s worth pointing out Cohen’s confidence about Power Packs in the interview I shared near the top of the article where he also claims it’s in beta simply because they can’t get enough inventory to sell. Assuming this is true, what a problem to have.

Push Start Arcade is in limited/beta rollout; GameStop has teased it publicly, but detailed mechanics and partner scope haven’t been formally disclosed yet. Though details remain light, it appears to expand on the PowerPacks mechanic but with a broader “digital arcade” interface.

So, the operating mix is shifting toward higher-margin collectibles, while the balance sheet, including low-coupon converts, give the company ample strategic optionality. Which brings me to…

“Monetize the Apes” M&A Possibilities

This is my favorite part, because it’s me riffing on strategy and what I think they can and should do with the balance sheet. I have a different view than just about everyone I’ve heard here.

When I hear speculation about M&A target opportunities, I most often hear about card grading companies, live stream operators, game developers, or even crypto companies. While I get it that these are related to the current business, I believe an alternative strategy is more accretive…

Arguably the most important asset that GameStop owns is not Bitcoin or cash on the balance sheet. It’s their retail army. As soon as Power Packs launched, the Reddit communities were flooded with “pull” photos. The army of apes want to support the company.

What if the M&A strategy focused on giving them new opportunities to support the company, by building a retail conglomerate? For each acquisition, all of a sudden a healthy percentage of the United States would switch on a dime or at least try to support the new acquisition where they can.

Almost any retail-facing acquisition could benefit from the army effect. They could buy Spirit Airlines for a bargain out of bankruptcy. They could buy some ridiculously small insurance company or bank, and immediately scale their client base overnight, eating market share. Insurance and banking are just math to me – if the rates are fair, I’m in! I particularly like the insurance idea – after all, Berkshire funds their operations through insurance premiums!

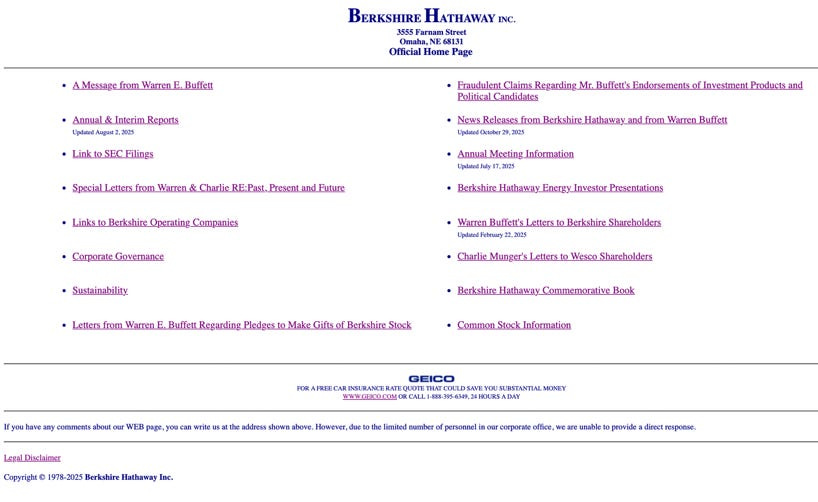

Speaking of Berkshire – and yes this is speculation – there is a clue that isn’t talked about much anymore. GameStop’s investor page sure looks a lot like Berkshire’s… Even the text at the bottom is identical: “If you have any comments about our WEB page.” This is not a coincidence, and might just be an obvious wink towards M&A strategy. I’m not saying Cohen is the next Warren Buffett, but perhaps GameStop is building their war chest to follow the Berkshire model.

The Tesla Effect (Reflexivity) — The Past Is Not The Present

I know many readers may already understand this concept and history, but based on the online vitriol around GameStop, its share price, and its prospects moving forward, I need to include a quick refresher as it’s clear many folks do not.

Tesla’s Near-Death Moment

The Tesla shorts were very arguably “right” on fundamentals several times in Tesla’s history, but that didn’t stop them from getting decimated. This has got to be the clearest case study in reflexivity we’ve seen, and we can draw from this experience in analyzing GameStop’s past and present.

The company was in a world of hurt in 2017-2018 – very reliant on selling regulatory credits and experiencing months of production delays, cost overruns, and quality issues creating a situation where free cash flow was deeply concerning and by Elon’s own account the company was within “a few weeks of bankruptcy” and in “manufacturing hell.” Short interest was over 30%, and prominent names were publicly short the stock, even comparing the company to Enron.

We all know what happened next. A herculean level of hustle and hard work, yes, to eke out sufficient delivery numbers. But also, Elon provided a steady stream of proclamations to “burn” shorts as well as wildly optimistic claims around future products and delivery timelines, which market participants chose to eat up, sending the stock on a massive short squeeze to wild market caps – up 10x from 2019-2021, burning the shorts indeed. As the stock price rose, it quite literally provided the financing needed to turn those valuations into hard assets and ramp up production and profitability.

While there’s still a great case to be made that the stock is overvalued, it’s not going to zero – value now plainly exists and Elon Musk is the wealthiest man in the world. This is reflexivity – a self-reinforcing loop where a rise in stock price actually creates company value.

The Lesson for GameStop

Bringing these lessons to GameStop, shorts were also fundamentally correct here in 2020 and 2021, but that doesn’t mean their short worked. The company was burning cash quickly as it was getting rapidly Amazon-ed – a dying retailer on its way to the graveyard to most eyeballs. However, one man saw Deep Value and he liked the stock – and whether you believe him or not he did not do anything illegal in my opinion while he shared his thesis and united a retail army, igniting the short squeeze we all remember so well.

Naturally, over the years GameStop has cashed in on this newfound company value, locking in this balance sheet value just as Tesla before it and providing plenty of runway to pursue a profitable path forward, playing offense with a healthy balance sheet rather than fighting to barely survive another day.

When I hear some people talk about GameStop, I get the feel that many don’t quite realize the nature of how reflexivity can create value out of nothing once that is transformed into balance sheet health. Once that value is there, the game has reset. The past is ancient history, and regardless of the short thesis of 2020, all that matters is today and the path forward from here.

GameStop is now valuable.

Reddit Theories and Pumps as a Bonus “Call Option”

The conspiracy stuff is fun and interesting, but it’s not my investment thesis. The fundamental thesis now stands on its own. I think the right way to look at these squeeze scenarios is as a welcome call option on an already sound investment.

I will say the warrant thing was interesting – why in the world would the board issue warrants to shareholders if not something to do with synthetic or lent shares? The White House GameStop retweet saying “Power to the Players” is interesting – maybe Eric Trump likes the stock. There is lots of Reddit tinfoil about something to do with papered over swaps from Archegos- or even GFC-related lending that is somehow tied to GME shorts – that is all above my IQ and not what I care to hunt down, but if something systemic were true, especially with issues in credit as of late, that would be interesting.

As a personal theory side note, I also wonder if Steve Cohen’s Point72 might be among the convertible note buyers – why else would they own GameStop puts if not to arb out the convertible notes?

The only other thing I’ll say about the conspiracies is that the price action seems very… let’s just say, strange. It often feels artificial and like holding a beach ball underwater, but as a bull of course I’m probably inclined to feel that way.

Putting the tinfoil together into a dense ball you can put in your pocket, the point of this section is that it’s not worth stressing over the unknowable, but these theories are a potential catalyst that do merit some “call option” type upside that should be considered gravy on top of an already very solid long-term fundamental outlook, rather than the investment thesis itself.

But if you get an opportunity, take it! Speaking of…

Volatility Breeds Income Opportunities

Another fun part, this one more on strategy. We all know the stock is volatile, and as a result I think the key to maximizing returns with this investment is to use the volatility to our advantage when we get opportunities to do so.

That doesn’t mean trade GameStop! If there’s one thing I’ve learned with GameStop it’s that this stock is something to own, not to trade. Volatility is your ally here if you can play the long game and use it to your advantage.

On the buy-side, this means to use dips to our advantage. I am honestly conflicted on buying in over time or buying in all at once, and will probably err towards the latter because I don’t want to miss a big move. Selling puts to initiate positions is at times an interesting option as well, especially to add to an existing position when implied volatility (option premiums) are high, but this of course risks missing out on upside.

But most importantly, I think it’s critical to take gains on any Roaring Kitty squeezes, White House pumps, or other random melt ups we may see. I will either take some off or sell expensive call options in those scenarios (again, if IV spikes premiums) to lock some gains even if I am keeping a position on for the long-term.

You have to know when it’s an offer you can’t refuse.

Final Notes

If my hypothesis turns out to be wrong or management fails to execute, I’ll of course change my thinking accordingly.

And outside of all this reasoning, it’s also just fun to be a GameStop shareholder…

I look forward to hearing your feedback, especially critical.

Power to the players!

Jeff

If you enjoyed this post, you can follow along on X and Substack below. Also if you want to know what I’m up to at Easter Egg Capital, you can find an overview here.

Substack: https://substack.com/@eastereggcapital

Last edited Nov 19, 2025 to correct financial statement inaccuracies, to provide a better Ryan Cohen interview link, and to include speculation about Steve Cohen’s Point72. No change to conclusions.

All content from Easter Egg Capital is for informational and entertainment purposes only. Nothing here should be taken as financial, investment, or trading advice – especially so for this post!